The rise of fintechs has created a world that demands interoperability, security, and simplicity in financial management. Financial institutions (FIs) must support their customers’ demands within a broad and complex ecosystem of applications that streamlines the sharing of financial data. Open finance analytics enables FIs to manage this integrated financial data sharing more effectively, gaining insight into new ways to improve data security, opportunities to enhance the user experience for business clients, retail customers, and third-party applications and products their customers are using.

Open Finance Enhances Control and Security

We have explored the disadvantages of screen scraping in detail in previous blogs, highlighting the lack of control and visibility customers have regarding what data is shared—and with whom. A common limitation of screenscraping is that there is no permissioning or revoking access to specific accounts or data, leaving business users open to security risks with limited control over the process.

Open finance offers a more reliable approach, providing secure data connections to customers’ preferred applications (data recipients) and ensuring bank administrators have visibility into all traffic generated by their customers. Financial institutions and their customers have complete control over data sharing and the ability to quickly and easily change or revoke third-party access to all accounts – an essential tool to ensure data security, privacy, and control. Open finance analytics helps financial institutions and customers maintain complete control over data sharing while providing deeper insights into security and usage patterns.

Ninth Wave Connect Leverages Open Finance Analytics for Improved Security and Control

Ninth Wave Connect is an open finance platform for FIs that provides secure data exchange in a true financial ecosystem, delivering unparalleled connectivity that allows consumer and business customers to securely and reliably share financial data with third-party applications. It elevates security by eliminating screen scraping, providing FIs early adherence to the CFPB Dodd Frank 1033 regulation.

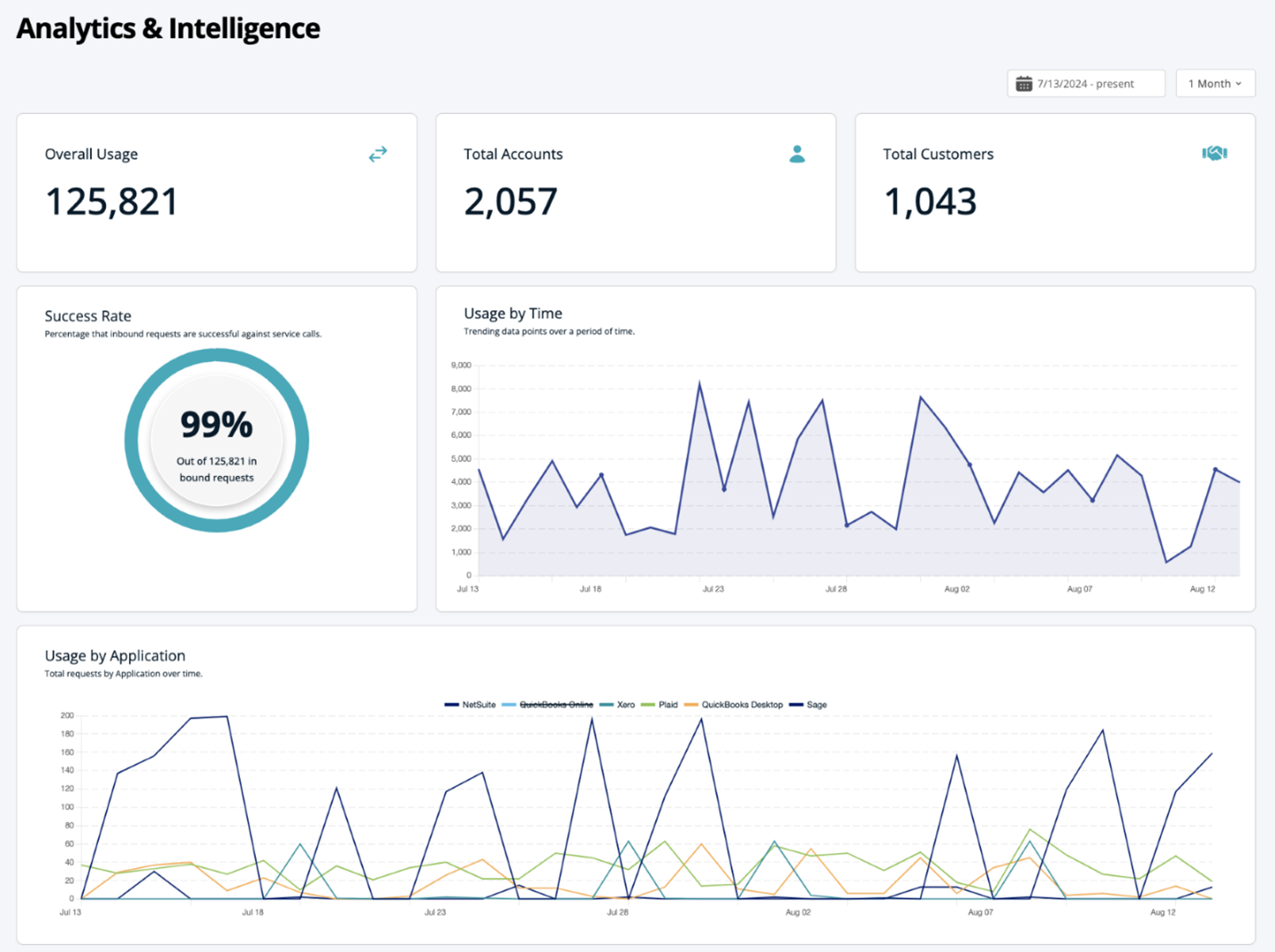

Ninth Wave Connect’s Analytics & Intelligence module further increases data security by providing insight into all third-party connections with clear, concise, and accurate analytics on all data requests coming in from external applications on behalf of financial institutions’ customers, including:

- Which applications are accessing data from the FI?

- How many open finance requests were made during a certain period?

- What is the volume of requests per application?

- Which fintech applications are accessing data through aggregator partnerships?

- How many customers are taking advantage of the connectivity and who are they?

- What are the performance and uptime statistics for the open finance APIs?

- What type of products and value are fintechs delivering to their customers that the FI isn’t providing?

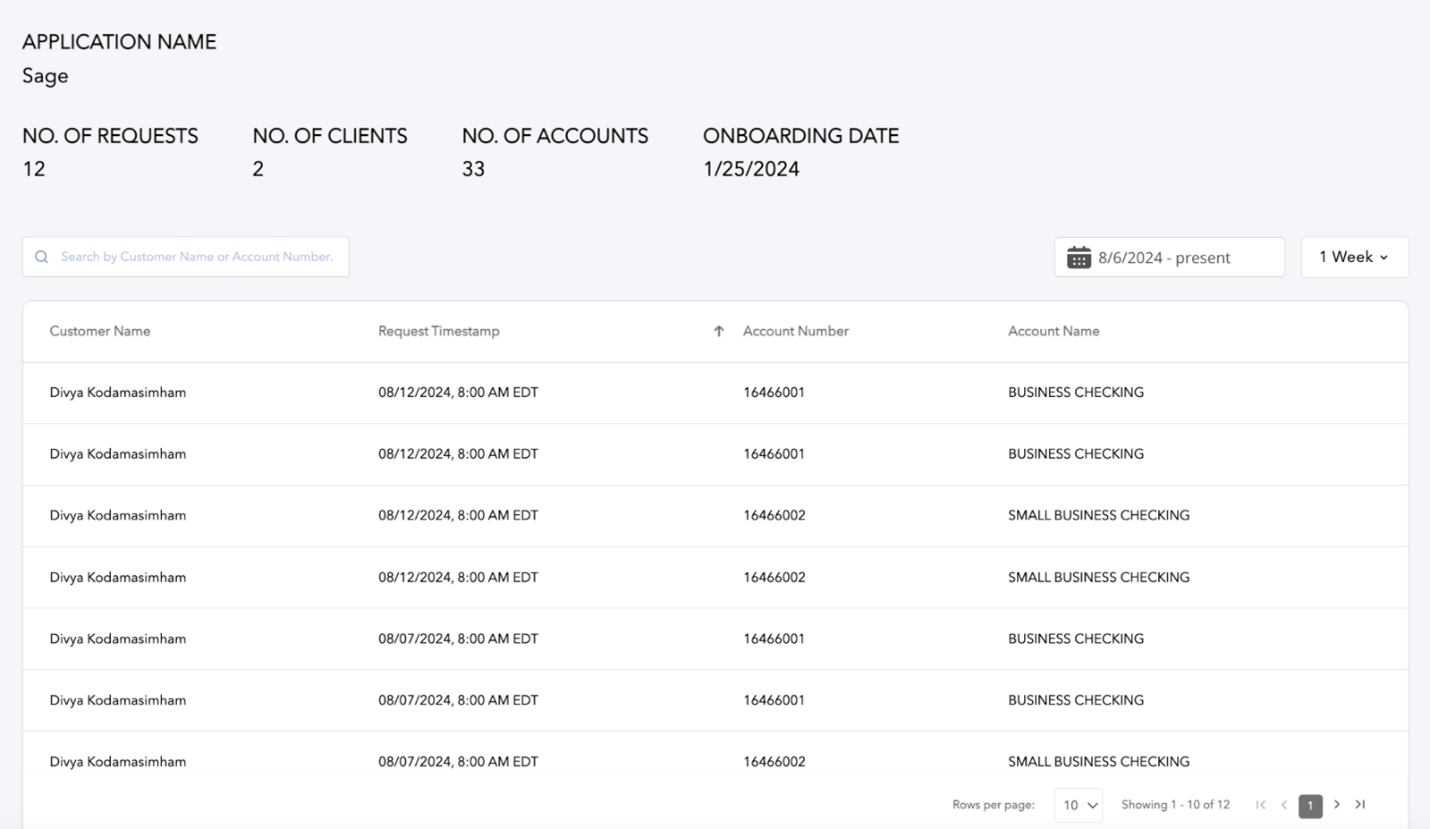

Ninth Wave’s Analytics & Intelligence acts as the financial institution’s lens into their open finance world, eliminating guessing which applications are driving customer usage, where customers are spending time in other technology products, and what types of products customers are using that should be evaluated as potential investments for product development. A comprehensive view into who is sharing data, how often it is being shared, and with whom it is shared also provides insight into customer behavior that can help identify suspicious activity. If the FI discovers suspicious activity, they can quickly revoke access – of a person, an entire client company, or to specific accounts – to safeguard against financial threats.

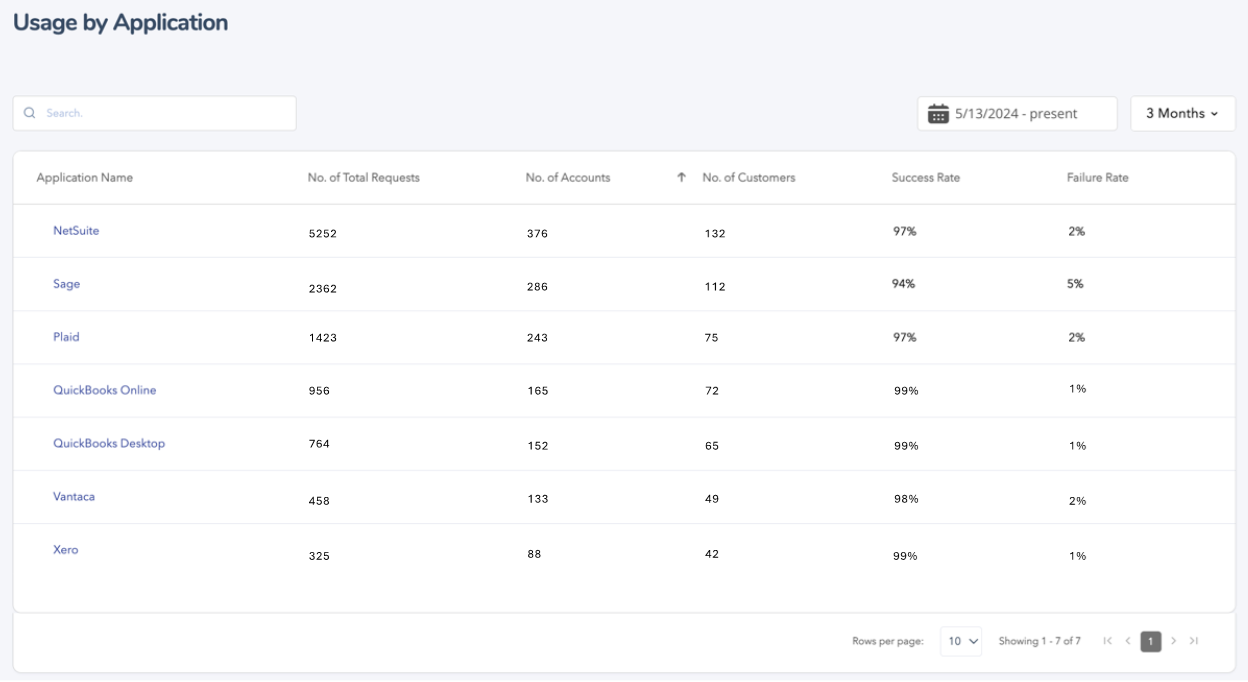

The information is available in real time via an easy-to-use dashboard within the Ninth Wave Portal, including access to the data behind the dashboard for additional analysis and reporting on usage and trends. Standard and customized reports can be generated for usage data based on a specified date range and application(s) selected. Standardized reports are available for general information, application usage, and consent management history as well as custom formatted reports for account analysis.

The Analytics & Intelligence feature provides a robust analytics interface for analyzing request traffic. Interactive business graphs provide dynamic and user-friendly visualization of data, allowing request data views in aggregate across all third parties or for a single application. Usage in a specific time period, success rates, total customers and accounts are available on the dashboard, with deeper insights into customers and application usage available on subsequent screens. Additionally, the Reporting feature provides financial institutions self-service customized usage reports in various formats.

Open Finance via APIs provides a more secure, reliable, and customizable way to share data. Implementing a single source of financial data connectivity like Ninth Wave enables complete control over the data sharing process. Ninth Wave Connect’s Analytics & Intelligence module takes that control a step further, providing insight into customer behavior that can both mitigate security threats and also highlight business opportunities based on which third-party applications their customers are using.

Ninth Wave is the leading enabler of secure data connectivity between financial institutions and third-party applications, including aggregators, fintechs, accounting solutions, tax preparation software, and other consumer and business solutions. Seven of the ten leading banks in the United States and eight of the top 10 U.S. wealth managers rely on Ninth Wave’s secure API-based access to integrate their financial data and provide for their customer bases.

Contact Ninth Wave today to learn how to improve your financial institution’s insight into customer behavior and third-party connections.

About Ninth Wave

Ninth Wave delivers secure, seamless, and standardized data connectivity to fintechs and financial institutions of all sizes, through a single point of direct integration to a universal suite of open finance APIs. With configurable controls, visibility, and insights into all data sharing and data acquisition connections between aggregators, third-party apps, and internal applications, Ninth Wave empowers financial institutions and their customers with access and oversight to their connected apps, enabling secure data exchange in a holistic and scalable open finance ecosystem. Offering solutions for retail and commercial banks, wealth managers, credit card issuers, tax providers, and more, Ninth Wave provides unparalleled connectivity and universal compatibility to complex information systems, unlocking innovation, potential, and performance for your data. Contact us to learn more about Ninth Wave’s secure data connectivity features. Empowering open finance. At scale, at last.