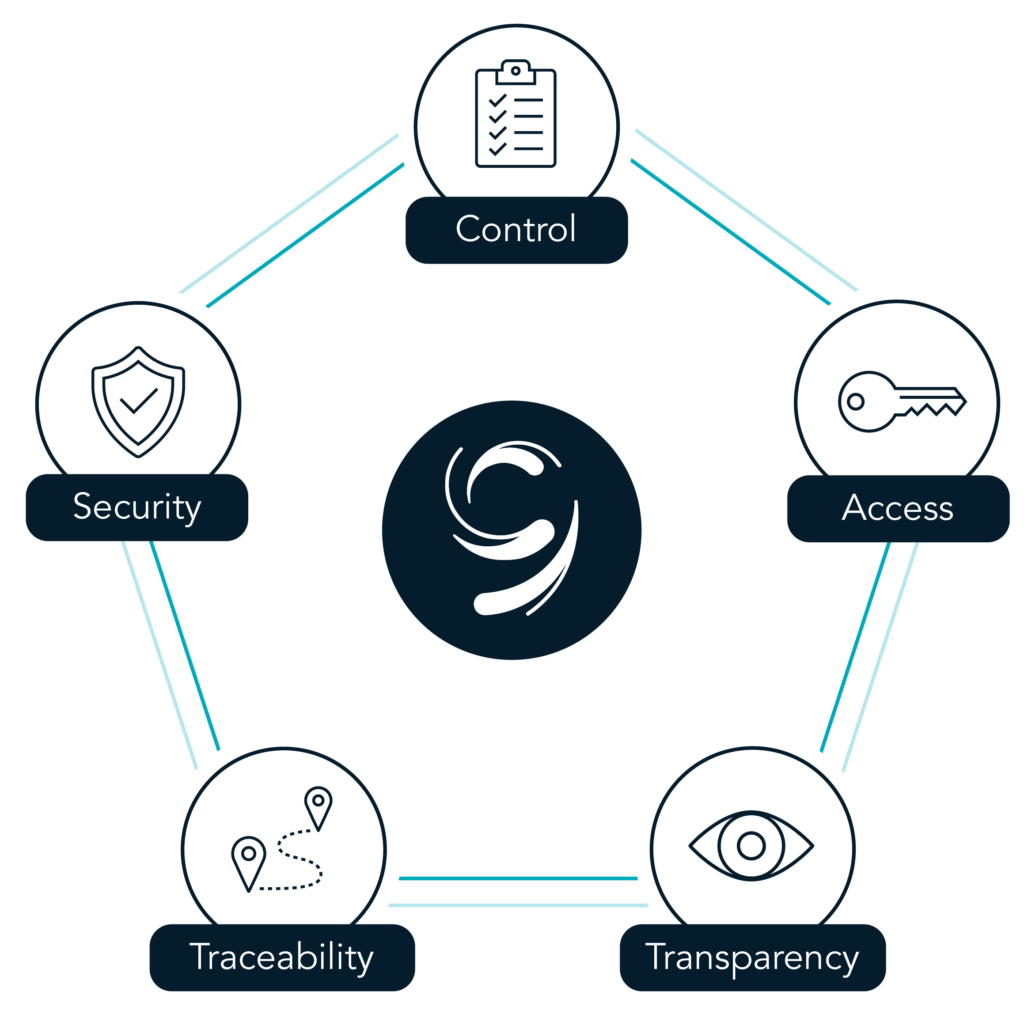

Ninth Wave empowers financial institutions, enabling secure data exchange in a holistic and scalable open finance software ecosystem.

Mitigate fraud with OAuth tokenization of customer credentials with control over token expiration

Integrate with bank security and authentication standards including multi-factor prompts and risk models