Harnessing the Power of the Ninth Wave Security Center

Demand for open, secure data access between banks and their clients is accelerating. Today, companies use a multitude of third-party applications from financial institutions to run their businesses – including applications for ERP, bill processing, accounting, taxes, and more. They need safe, reliable data connectivity between banks and the applications to ensure they process payments and taxes on time, properly manage financial reports, and maintain a comprehensive, accurate view of the financial status of their businesses.

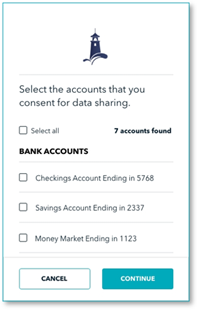

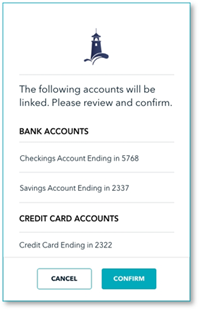

Critically, they need control over which accounts (checking, savings, money market, credit card) they want to grant – or revoke – access to, with the ability to grant/revoke access at any time for any reason. Changing market dynamics, security threats, new technology, and evolving business needs may require companies to quickly shift access from one application or account to another. Full control is the key.

Managing Data Access

Ensuring bank clients have complete transparency and control over these connections is essential, including the ability to choose exactly which accounts – and which data elements – are shared with each individual third party. Some applications need access to more accounts, and some need access to more granular data from individual accounts.

Having this level of control over which accounts and which data elements are shared increases data privacy, financial control, and security. In the past six months, the United States has experienced some of the biggest, most damaging data breaches in recent history. Avoiding unnecessary data sharing is one way to limit exposure to data breaches.

The ability to quickly and easily change or revoke third-party access to all accounts, or specific accounts or data elements, is also essential to ensure data security, privacy, and control.

- A business may want to replace older applications with new ones with enhanced functionality, requiring them to turn off access to the older app and turn on access to the new one. They need to make this change quickly and completely, so no payments are missed or incorrect reports created.

- A company may want to change which credit cards to use with which accounts and need to toggle access on for the new account and off for the old one.

- Data breaches can occur that make one application temporarily vulnerable. If that happens, a company may want to turn off all or partial access to that app while the situation is resolved. They may not have time to call the bank to figure out how to disconnect from the app because they need to disconnect immediately to reduce the risk of having their data accessed in the breach.

The Ninth Wave Security Center – Complete Control at Your Fingertips

The Ninth Wave Security Center provides bank administrators and customers secure data access and complete visibility into all third-party application connections, including the ability to provide and revoke consent at the individual account level, in just a few simple steps.

Ninth Wave Security Center allows you to provide your business customers with a seamless, white-labeled account control experience:

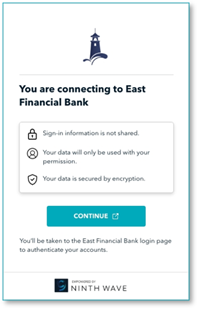

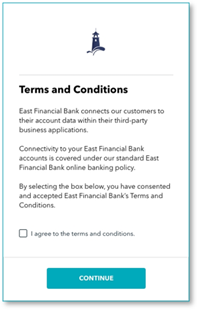

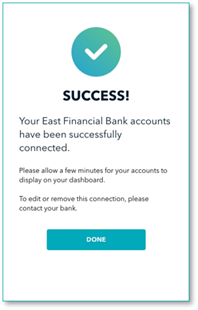

Ninth Wave provides an easy-to-use authentication and consent workflow that is embedded directly into the existing user experience of the third-party applications. Users follow a step-by-step process to identify exactly which datasets and accounts will be shared with each third-party application, retaining complete control throughout the workflow and ultimately consenting to the data sharing that will be available to the third-party app for a set of accounts.

Ninth Wave captures this consent information – for both the app and the account(s) – during the process. The consent information is made available to bank administrators and bank customers through the Ninth Wave Security Center.

Users can view the list of all third-party applications that have access to their account information and use simple toggles to turn access to account information on or off for each application.

Banks can make the Ninth Wave Security Center available to their customers by adding it to their existing online banking (OLB) systems. Bank administrators can also access the Ninth Wave Security Center through the Ninth Wave Portal.

Secure Connections with Ninth Wave

Ninth Wave provides banks and their customers complete control of all their connected apps. Bank customers can log into their bank’s OLB system and use a simple workflow to grant access to third-party applications, review the status of all app data access, and quickly and easily make changes. The Ninth Wave Security Center makes managing application access easy, helping banks and their customers maintain secure data access and complete control of their accounts.

Reach out to Ninth Wave today to learn how the Ninth Wave Security Center provides you and your customers secure control of account connections with third-party applications.

About Ninth Wave

Ninth Wave delivers secure, seamless, and standardized data connectivity to fintechs and financial institutions of all sizes, through a single point of direct integration to a universal suite of open finance APIs. With configurable controls, visibility, and insights into all data sharing and data acquisition connections between aggregators, third-party apps, and internal applications, Ninth Wave empowers financial institutions and their customers with access and oversight to their connected apps, enabling secure data exchange in a holistic and scalable open finance ecosystem. Offering solutions for retail and commercial banks, wealth managers, credit card issuers, tax providers, and more, Ninth Wave provides unparalleled connectivity and universal compatibility to complex information systems, unlocking innovation, potential, and performance for your data. Contact us to learn more about Ninth Wave’s secure data connectivity features. Empowering open finance. At scale, at last.