The new Consumer Finance Protection Bureau (CFPB) Personal Financial Data Rights rule, also referred to as Dodd-Frank Act 1033 Implementation, is set to reshape the financial market in the United States by giving consumers greater control over their financial data.

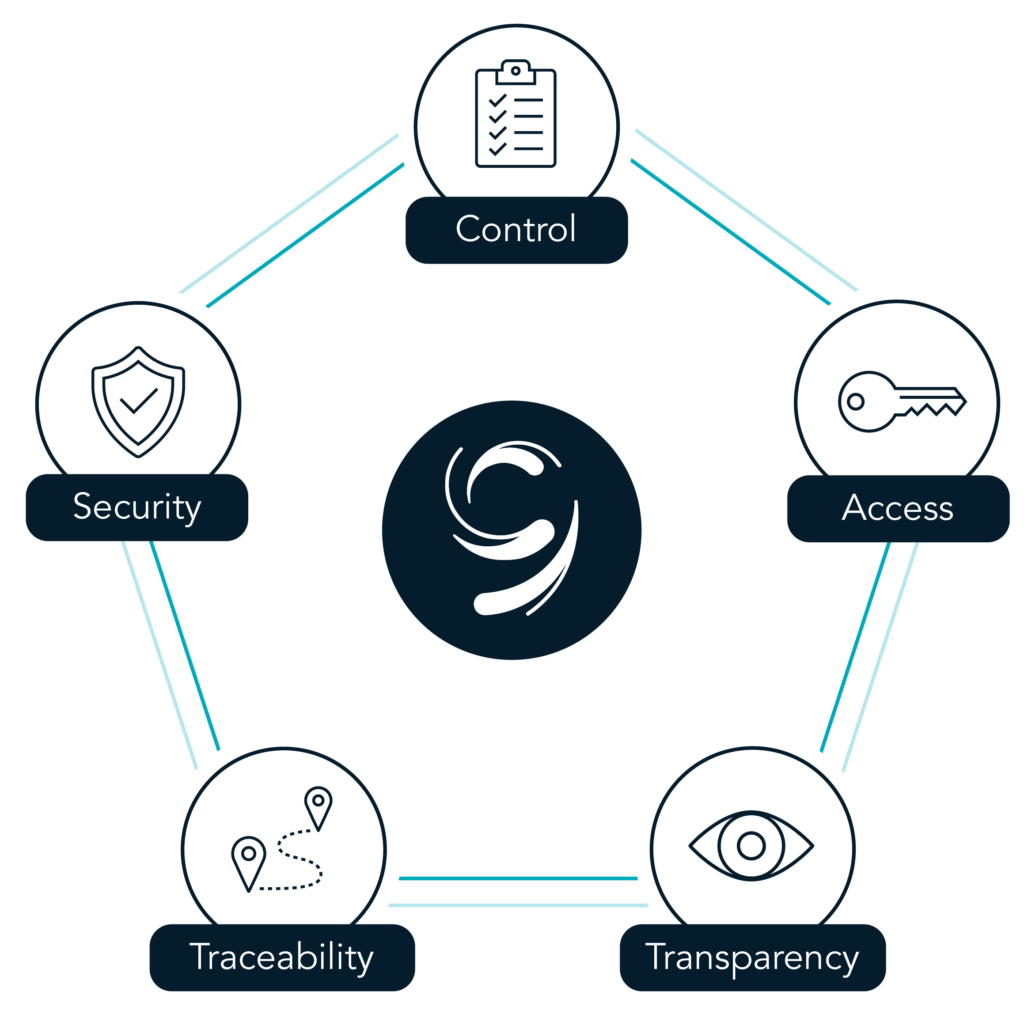

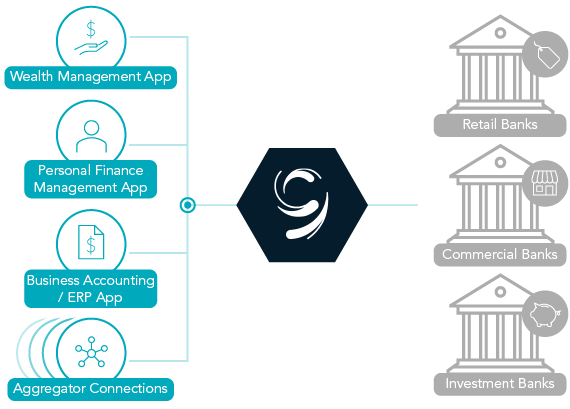

Ninth Wave’s platform is an enterprise solution for financial institutions (FIs) that enables consumers and business customers to share financial data securely and reliably with third parties, making it a comprehensive solution to all Personal Financial Data Rights rules implemented by CFPB.

Developer interface (API) for financial data sharing

Ninth Wave partners with FIs to enable a set of open finance APIs that allow consumers to securely access their accounts, transactions, and other kinds of financial information in their preferred third-party applications.

APIs are available publicly and well documented

Ninth Wave's Developer Portal makes APIs easily accessible with supporting sandbox capabilities and documentation. Ninth Wave provides access for development and testing to developers at third-party providers (TPPs) and/or FIs.

Ninth Wave's Developer Portal can also be white-labeled on behalf of clients.

Data must be in a standardized, machine-readable format

Our open finance APIs are designed to be interoperable — built according to Financial Data Exchange (FDX) standards, ensuring their implementation follows a commonly adopted standard.

Our platform is protocol-agnostic, combining open standards support and custom APIs to meet FIs needs.

Third-party access to financial data is possible on behalf of the consumer

Our APIs enable data access for TPPs servicing a multitude of use cases including personal finances management, accounting reconciliation, payments, tax preparation, and wealth management.

In addition to providing access to the APIs, our platform enables fintech applications and aggregators to dynamically register their client applications using Dynamic Client Registration (DCR) as well as to enable the applications' end-users.

TPP authorization can be confirmed and consumers can make an informed decision on whether to grant the TPP access to their data

The platform ensures robust fine-grained customer authorization through three-legged OAuth protocols.

With Ninth Wave, the user's consent is verifiable at an applications and account level, allowing the user to be specific in terms of which accounts are consented for individual applications.

Data-sharing consent can be revoked at any time

The Ninth Wave platform enables customer-level revocation of data-sharing permissions and has the consent administration portal built in.

FI is able to confirm customer identity

Ninth Wave utilizes a preferred three-legged OAuth authentication model with integration to the financial institution's identity management solution and and/or authentication server.

FI is able to confirm the TPPs identity

Ninth Wave uses OAuth standards and DCR to enable TPPs to register their client applications, authenticate them, get access tokens, and access the APIs.

Ninth Wave not only aligns with CFPB’s stringent requirements but also goes beyond, providing a secure, user-centric pathway for compliance. With Ninth Wave, financial institutions can confidently navigate the intricate landscape of data-sharing regulations, ensuring operational efficiency and a robust approach to consumer data protection.