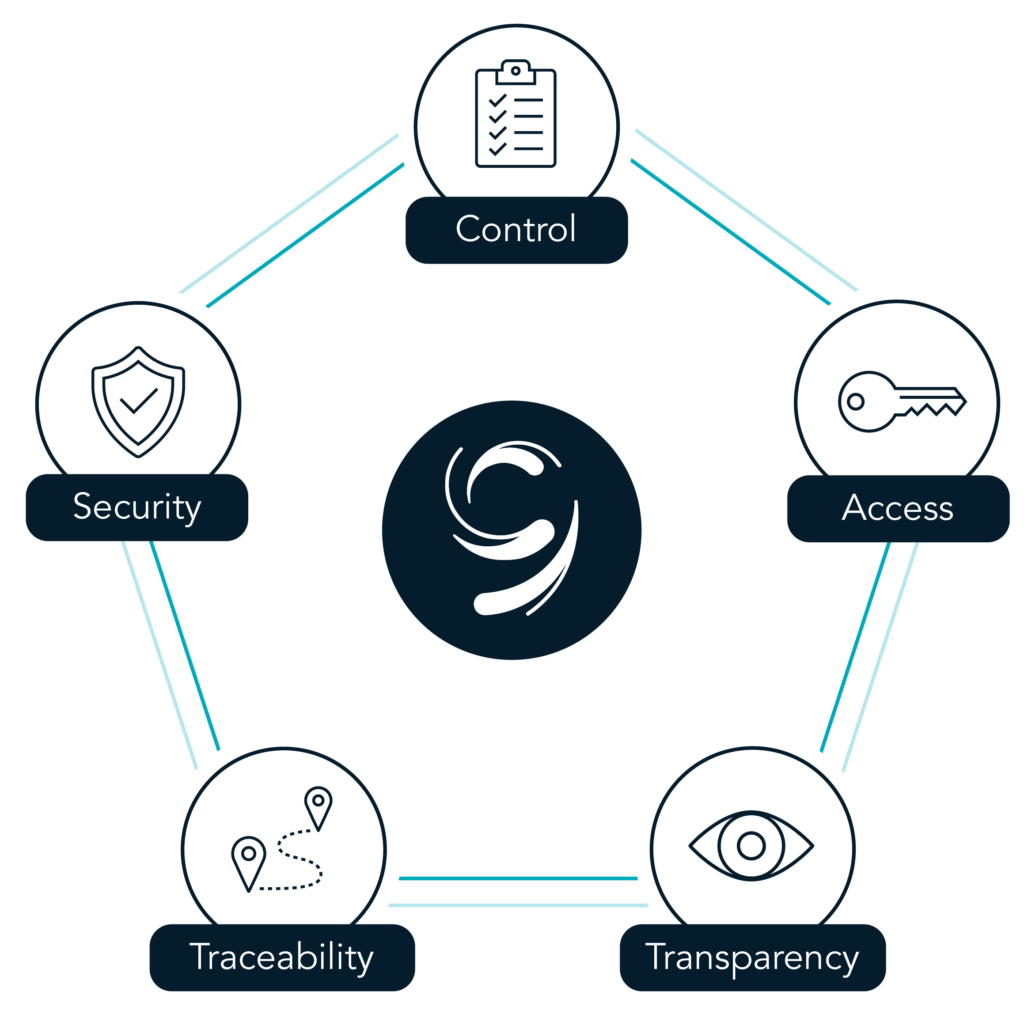

Ninth Wave partners with many of North America’s top financial institutions, offering an Open Finance Hub that connects over 120 million accounts through secure, reliable, and scalable links to the entire open finance ecosystem.

Mitigate fraud with OAuth tokenization of customer credentials with control over token expiration

Integrate with bank security and authentication standards including multi-factor prompts and risk models